Australian Company Director Identification Number Requirements

Introduction

On 4 April 2021, the Treasury Laws Amendment (Registries Modernisation and Other Measures) Act 2020 (Cth) commenced – implementing Part 9.1A of the Corporations Act 2001 (Cth) (Corporations Act), which introduces the new director identification number (DIN) initiative.

From November 2021, directors of Australian companies (including existing directors and directors being appointed) will need to verify their identity by obtaining a DIN, being a unique identifier that a director must apply for once and keep forever.

Director identification numbers (DINs)

A DIN is a 15-digit identifier provided to a director once they have verified their identity with the Australian Business Registry Services (ABRS), which is managed by the Australian Tax Office (ATO). The ARBS is a new authority introduced to address how business information is registered, maintained and viewed. The objective of requiring a DIN is so that shareholders, employees, creditors, consumers and regulators can readily identify the details of the director of a company. It is a legal requirement that a director verifies their identity before registering their DIN, for the purposes of preventing the use of false director identities and eliminating involvement in unlawful activity such as insolvent trading and illegal phoenix activity.

A DIN will remain with the same director forever, regardless of whether they change companies, stop being a director, change their name or move interstate or to another country. Those requiring a DIN are eligible officers who are appointed as a director (or an alternate director who is acting in that capacity) in respect of a company that is:

- a registered Australian or foreign body under the Corporations Act; or

- an Aboriginal and Torres Strait Islander corporation under the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act).

A DIN is also required for directors of:

- a corporate trustee (eg a self-managed super fund), charity or not-for-profit organisation;

- a registered Australian body (eg an incorporated association registered with ASIC that operates outside the state or territory in which it is incorporated);

- a foreign company registered with ASIC and carrying on business in Australia.

However, DINs are not required for:

- company secretaries that are not also directors;

- individuals acting as an external administrator of a company;

- individuals running a business as a sole trader or partnership;

- individuals not appointed as a director under the Corporations Act or CATSI Act but who are referred to as ‘directors’;

- directors of a registered charity with an organisation type not registered with ASIC;

- officers of an unincorporated association, cooperative or incorporated association established under state or territory legislation.

Applying for a DIN

An individual cannot apply for a DIN on behalf of someone else. The person who is the director must apply for the DIN themselves. Directors are able to apply for a DIN from November 2021, and the mandatory application date will depend on the date an individual became (or becomes) a director.

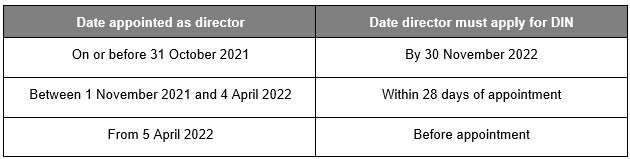

Directors who have been appointed prior to 31 October 2021 will have until 30 November 2022 to apply for a DIN. Further, there will be a transitional period following the commencement of the regime where any person appointed as a director between 1 November 2021 and 4 April 2022 will have 28 days to apply for a DIN. Following the transitional period, individuals will need to apply for a DIN before being appointed as a director.

In summary, for directors appointed under the Corporations Act, the DIN application date requirements are as follows:

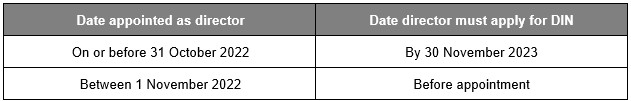

For directors appointed under the CATSI Act, the DIN application date requirements are as follows:

Application for a DIN is free and requires a myGovID account to be created prior to preparing the application. In order to submit the application, the director must provide details of their name, addresses and former addresses, tax file number and information verifying their identity via two documents (e.g. bank account details, dividend statements, PAYG payment summary).

Consequences of failing to comply with DIN requirements

There are four paramount obligations under the DIN regime. Directors must:

- apply for a DIN prior to being appointed as a director or within a prescribed period of being directed to do so by the registrar (as outlined above);

- not apply for multiple DINs;

- not provide false identity information to the registrar during the DIN application process; and

- not misrepresent a DIN to a government body or registered body.

Failure to meet any of these DIN obligations may result in an infringement notice being issued or civil or criminal penalties. The maximum penalties for failing to comply with DIN requirements are 60 penalty units or one year of imprisonment.

Conclusion

The ARBS notes that the DIN regime is a beneficial and convenient measure to ensure full disclosure of a director’s identity and history as company officer in an effort to tackle illegal ‘phoenixing’ activities, and increase director accountability and traceability. Given the penalties for non-compliance with the DIN requirements, it is essential that all eligible directors obtain a DIN.

Queries

For further information please contact the authors, or any member of our Corporate & Commercial team.

Disclaimer

This information and the contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders, and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.