Why Disclosure is Not Nine-Tenths of the Law: The New Design and Distribution Obligations in Australian Credit and Financial Services

NB: The following article is published in the LexisNexis Australian Banking & Finance Law Bulletin – (2021) Volume 37, page 84.

Introduction

For decades, the regulation of credit and financial services in Australia has relied heavily on disclosure as a primary tool for securing appropriate regulatory outcomes. More recently it has been recognised that the neo-liberal assumption that individuals behave rationally in purchasing credit and financial services is flawed because it overlooks behavioural biases. Those biases limit the effectiveness of disclosure as a regulatory tool and “can lead to sub-optimal outcomes for consumers.”[1] The shortcomings of disclosure as a regulatory tool has led to the recognition that consumers are sometimes sold products that are not suitable to their needs and circumstances. As noted in the Financial System Inquiry Interim Report in 2014, mechanisms like disclosure are “unlikely to correct the effect of broader market structures and conflicts that drive product development or distribution practices” that result in negative consumer outcomes.[2]

This is the context in which issuers and distributors of financial products, including credit facilities, will need to comply with the new design and distribution obligations (DDO) regime from 5 October 2021. The DDOs are introduced through the amendments to Chapter 7 of the Corporations Act 2021 (Cth) (Corporations Act) to add a new Part 7.8A to this law. The DDOs are intended to ensure issuers and distributors take a consumer centric approach when designing, marketing and distributing financial products.

The DDOs apply to both new financial products and continuing financial products. Under the new regime, issuers must design financial products that are likely to meet the objectives and needs of the consumers to whom the financial products are targeted, issuers and distributors must take reasonable steps to ensure that the financial products are reaching the consumers to whom the financial products are targeted and issuers must continuously review the financial products to ensure the financial products continue to meet the objectives and needs of the target consumers.[3] This is done through the issuers preparing and making publicly available, a Target Market Determination (TMD). The TMD is a written document which describes the target consumers of a financial product and other matters relevant to the design and distribution of the financial product. The issuers and distributors must then take reasonable steps to ensure the financial products are distributed and managed in line with the TMD.

The new DDO regime is intended to address the limitations of relying too heavily on disclosure and financial advice as regulatory tools. The DDOs will apply to most financial products regulated by the Australian Securities & Investments Commission (ASIC) under the Australian Securities and Investments Commission Act 2001 (Cth). These products include credit products such as “buy now pay later” arrangements[4] and other credit facilities to retail clients. However, it is critical to note that, among other exceptions, the DDOs will not apply to a credit facility under the terms of which the credit is, or must be, applied wholly or predominantly for business purposes (the “business purpose” exception).

Section one of this article provides an outline of the framework and obligations under the DDO. Section two focuses on the business purposes credit exception and section three describes the key steps a regulated financial services provider must take to comply with the DDOs.

Section A: Framework and obligation under the DDO

Target Market Determination

At the crux of the DDO is the requirement to produce, make publicly available and comply with a TMD. The DDOs prescribe a number of content requirements for a TMD.[5] A TMD should include, among others, a description of the class of consumers that comprise the target market for the product, specify any conditions or restrictions on distributing the financial product, specify any events that would trigger a review of the TMD and its appropriateness for the financial product and specify when the TMD is to be periodically reviewed.[6] The TMD must be such that it would be reasonable to conclude that issuing and distributing the product in accordance with the TMD would likely result in the correct retail clients being targeted and the product would likely be consistent with the likely objectives, financial situation and needs of the targeted retail clients.[7]

Duties of issuers and distributors

Issuers and distributors have different but overlapping obligations to comply with the DDOs and the TMD. Broadly, for the purposes of the DDOs, an issuer is a person who issues a financial product and is obliged prepare the applicable disclosure documents. A distributor, on the other hand, is a person who distributes a financial product. This includes Australian financial service licensees, authorised representatives of the issuers, credit licensees and credit representatives.

An issuer is required to prepare a TMD, make it publicly available, take reasonable steps to ensure the distribution of the product complies with the TMD, review the TMD for appropriateness, and notify ASIC of any significant dealings. Significant dealings are any dealings that are not consistent with the TMD and can vary depending on the financial product and the specific circumstances.[8] A distributor must not distribute a financial product unless a TMD has been provided, must take reasonable steps to ensure the distribution is in line with the TMD, notify the issuer of any significant dealings and keep accurate record of distribution information.[9]

Legal framework for the DDOs

The DDO have been introduced through the Treasury Laws Amendment (Design and Distribution Obligations and Product Intervention Powers) Act 2019 (Cth) and the Corporations Amendment (Design and Distribution Obligations) Regulations 2019 (Cth). The DDO are applicable to financial products described in section 994B(1) of the Corporations Act. Section 994B(1) has adopted a wider definition of ‘financial products’ than the Corporations Act. Under the section, financial products are defined to include products that:

- require the providing of a prospectus to investors or product disclosure statement under Part 6D.2 and Part 7.9 of the Corporations Act;

- are not regulated under Part 6D.2 and Part 7.9 of the Corporations Act but are within the definition of financial products under the Division 2 of Part 2 of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act), provided the products are issued to retail clients or are sold under a ‘regulated sale’ (as defined in the Corporations Act); and

- are set out in the Corporations Regulations 2001 (Cth) (Corporations Regulations) which, among others, include depository interests in simple corporate bonds, debentures of certain companies, basic banking products and exchange traded products.

The broad definition of financial products under Part 7.8A means that DDO will apply to a wide range of credit products. Notably, this includes credit facilities, provided they are targeted at retail clients, including those products already regulated under the National Consumer Credit Protection Act 2009 (Cth). This is because credit facilities are a type of financial product under the ASIC Act.

“Credit facility” is defined broadly. A credit facility can include, among other things, the provision of credit for any period, with or without prior agreement between the credit provider and the debtor, a guarantee of obligations under a credit contract or the provision of a mortgage that secures obligations under a credit contract. Regulation 2B of the Australian Securities and Investments Commission Regulations 2001 (Cth) (ASIC Regulations) sets out the complete definition of credit facility. The term “credit” is defined under the ASIC Regulations as a contract, arrangement or understanding under which a person’s obligation to pay debt is deferred or one person (the debtor) incurs a deferred debt to another person (the credit provider). This can include, among other things, any form of financial accommodation, hire purchase agreement, credit provided for the purchase of goods or services and the supply of a credit card.[10] This means a “credit facility” is not limited to loans in the strict sense but can encompass financial accommodation more generally: for example, invoice financing arrangements would be caught. Other types of accommodation that are covered by the definition of “credit facility” would include working capital facilities (loans), credit provided by pawnbroking services and buy now pay later services.

Exceptions from the DDOs

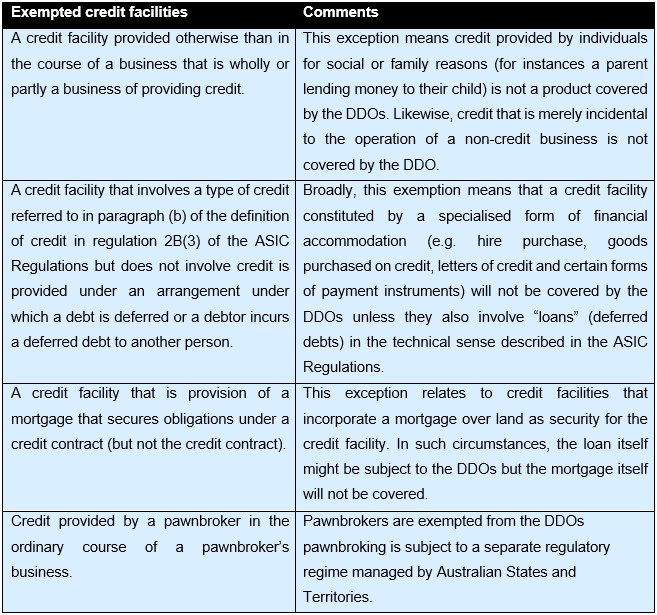

Despite the broad definition of ‘financial products’ under Part 7.8A, under the Corporations Act and Corporations Regulations certain financial products not covered by the DDOs. These include MySuper Products, margin lending facilities, securities issued under an employee share scheme, most fully paid ordinary shares in a company including a foreign company and certain types of credit facilities.[11] The next section of this article explores the exception for credit facilities provided wholly or predominantly for a business purpose. However, set out below are the other types of credit facilities which are not covered by the DDOs.[12]

Section B: The business purpose exception

As noted above, a financier providing financial accommodation under the terms of which the accommodation is, or must be, applied wholly or predominantly for a business purpose will be covered by the business purpose exception to the DDOs. The Corporations Act and the Corporations Regulation does not expand on what constitutes as a business purpose, however the National Credit Code, being schedule 1 to the National Consumer Credit Protection Act 2009 (Cth) can be used for guidance to understand what constitutes as a business purpose. (It is important to note that credit regulated by the DDOs is not limited solely to credit that regulated by the National Credit Code. However, the interpretation of “predominantly” under the Code is helpful in interpreting how a credit product that is not regulated by the Code – but is still potentially within the scope of the DDOs – is in fact exempted from the DDOs.)

The National Credit Code provides a “consumer protection framework for consumer credit and related transaction” and does not apply to credit provided for a business purpose.[13] Section 5 of the National Credit Code describes the type of credit that is regulated by the National Credit Code. This section and the National Credit Code in general can be used as a guidance to determine what constitutes as a business purpose. Using section 5 of the National Credit Code as a guide, a credit facility will not be taken to be for a business purpose where the debtor is a natural person or a strata corporation and the credit is provided or intended to be provided wholly or predominantly:

- for personal, domestic or household purposes;

- to purchase, renovate or improve residential property for investment purposes; or

- to refinance credit that has been provided wholly or predominantly to purchase, renovate or improve residential property for investment purposes.

In interpreting the word “predominantly” for the purposes of the business purpose exception to the DDOs, we suggest that it would be reasonable to have reference to section 5 of the National Credit Code. Under the Code, a purpose is a business purpose where more than half of the credit is used for a business purpose or if the credit is used to acquire goods or services which are intended to be used mostly for a business purpose.[14]

Given the above, we suggest that a financier providing invoice financing arrangements, working capital facilities, equipment financing facilities and other similar arrangements to businesses will be within the business purpose exemption to the DDOs. However, in each case it is necessary to review the product features and terms of use carefully to confirm that the the business purpose exemption does indeed apply, or else the product falls within one of the other credit product exemptions outlined earlier in this article.

Section C: Next steps

Issuers and distributors should consider whether the financial products issued or distributed by them are covered by the new regime. If so, a Target Market Determination should be prepared, and processes should be put in place to ensure compliance with the new regime.

Any financiers who are in the business of providing credit facilities for a business purpose should ensure that the terms of their credit products provide that the customer must apply the credit wholly or predominantly for business purposes.

Queries

If you have any questions about this article, please get in touch with an author or any member of our Banking & Finance or Fintech, Privacy & Emerging Technologies teams.

Disclaimer

This information and the contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders, and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.

The views expressed are those of the authors and do not necessarily reflect those of Cornwalls.

[1] Commonwealth of Australia, Financial System Inquiry Final Report (November 2014) p. 9, available at https://treasury.gov.au/publication/c2014-fsi-final-report (accessed 16 September 2021).

[2] Australian Government Treasury, Financial System Inquiry Interim Report (August 2014) available at https://treasury.gov.au/sites/default/files/2019-03/p2014-fsi-interim-report.pdf (accessed 16 September 2021).

[3] Australia Securities and Investments Commission, Product design and distribution obligation (December 2020) https://asic.gov.au/media/5899239/rg274-published-11-december-2020-20201218.pdf (accessed 16 September 2021).

[4] Australia Securities and Investments Commission, Buy Now Pay Later: An Industry Update (November 2020) https://download.asic.gov.au/media/5852803/rep672-published-16-november-2020-2.pdf industry update (asic.gov.au)(accessed 16 September 2021).

[5] Corporations Act 2001 (Cth) s994B(5).

[6] Corporations Act 2001 (Cth) s994B(5).

[7] Corporation Acts 2001 (Cth) s994B(8).

[8] Corporations Act 2001 (Cth) s994B, s994C, s994E and s994G.

[9] Corporation Acts 2001 (Cth) s994D, s994E and s994F.

[10] Australian Securities and Investments Commission Regulations 2001 (Cth) reg 2B.

[11] Corporations Act 2001 (Cth) s994B(3) and Corporations Regulation 2001 (Cth) reg 7.8A.20(9).

[12] Corporations Regulation 2001 (Cth) reg 7.8A.20(9).

[13] Explanatory Memorandum, National Consumer Credit Protection Bill 2009, 239.

[14] National Credit Code (2009), s5(4).