On the Rise and Rise of Stablecoins

While digital assets like Bitcoin or Ethereum rise and fall sharply with volatility as their only constant, another asset class that has kept its price constant has been growing over time. Indeed, total market capitalisation for stablecoins has grown fourfold in 2021 alone and continues to grow. [1] In Australia, ANZ recently announced its foray into this space with the launch of the A$DC stablecoin.[2]

The Financial Stability Oversight Council reported that in the twelve months ending October 2021, the market capitalisation for stablecoins has grown 500% to reach USD $127 billion market capitalisation.[3] In the five months since that report was issued, the market has grown a further 50% (to reach USD $189 billion as of the time of writing).[4]

This stable cryptocurrency merits some attention. Any examination of stablecoins would require an understanding of the interaction of three frameworks: economic, technical and regulatory.

A brief history of money

When in 1875 William S Jevons described how money functions to overcome the limitations of barter.[5] Money’s a matter of functions four, A Medium, a Measure, a Standard, a Store.[6] Most modern economists have since dropped the Standard (of debt) and now claim three functions of money, as:

- a medium of exchange (Medium) that can facilitate trade even where only one desires what the other supplies.

- a unit of account (Measure) that can be used as a single measure to price all things (from houses to oranges) and furthermore, be subdivided.

- a store of value (Store) is a way of transferring purchasing power from the present to the future (though perhaps not as well as gold or property).[7]

From the origins of sovereign-backed money, such as the Lydian Slater (6th Century BCE) until 1971, money was backed by physical commodities, typically gold (Commodity money). When on 15 August 1971, the US dollar, and along with it the global supply of money pegged to it was no longer constrained by any physical commodity, Fiat money was born (Fiat).[8] Since then, the US dollar lost 98% of its value when compared to gold.[9] [10] [11]

On 3 January 2009, following the Global Financial Crisis and subsequent bailouts, Satoshi Nakamoto, the pseudonymous creator of Bitcoin released the genesis block of the Bitcoin network.[12] Bitcoin combines encryption, decentralised computing and game theory to create a currency that keeps inflation in check (there is an upper limit of 21 million coins).

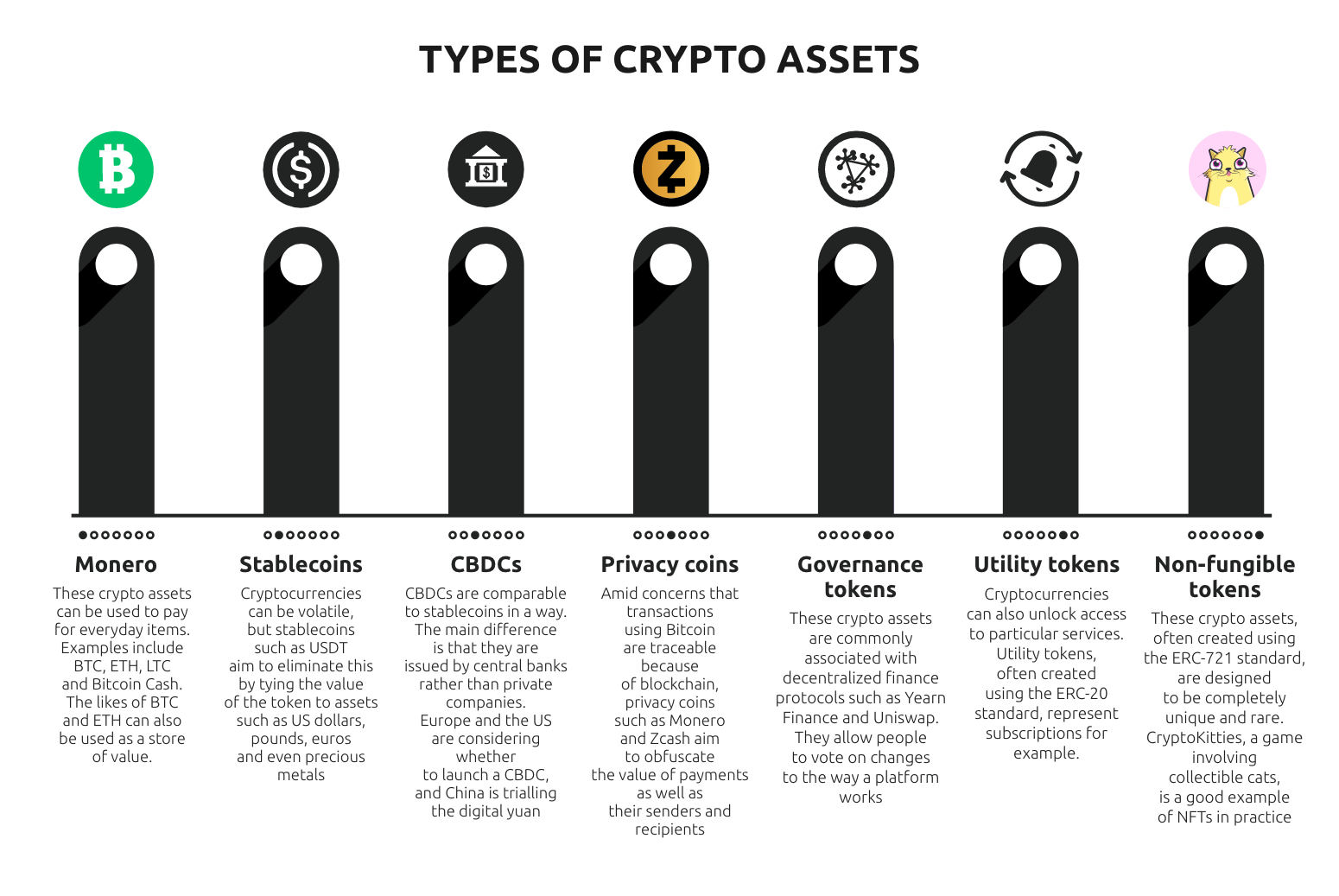

Since the advent of bitcoin, thousands of cryptocurrencies emerged. They can generally be classified as one of the following categories:

- Payment coins (currency or monero) are used to replace cash (eg. Bitcoin, Bitcoin Cash).

- Stablecoins – coins pegged to the value of other assets (eg. USD Tether).

- CBDC (Central Bank Digital Currency) – government-issued stablecoins (eg. Digital Yuan).

- Privacy coins – payment coins that obfuscate sender and receiver information (eg. Zcash).

- Governance tokens – managing voting rights for decentralised protocols (eg. Uniswap).

- Utility tokens – tokens that unlock access to a service (eg. Ethereum).

- Non-fungible Tokens – unique tokens incorporating digital (or representing physical) assets (eg. Cryptokitties).

- Security tokens – tokens that represent ownership right (eg. Tokenised REITs).

Source: currency.com

Bitcoin was to act as a peer-to-peer payment mechanism. In practice, however, the utility of Bitcoin as a Medium has been dampened by speculation about its value as Store and the price volatility associated with speculative trading.[13] This is consistent with Hayek’s concerns in the Denationalisation of Money about the utility of an intrinsically or speculatively valuable currency as a media of exchange.[14] Most Bitcoin holders (or ‘hodlers’) would likely seek to avoid the story of Laszlo Hanyecz who spent 10,000 Bitcoins (today worth over USD $400 Million today) to purchase two pizzas back in May 2010.[15] Such concern coupled with relatively high transaction costs have dampened Bitcoin’s utility as an efficient Medium.

As such, the need for a reliable, secure, stable and efficient medium of exchange for cryptocurrencies was born.

What are stablecoins?

A stablecoin is “a crypto-asset that seeks to stabilise the price of the ‘coin’ by linking its value to that of a pool of assets, making it a reliable and attractive store of value.”[16] ASIC in a recent submission defined Stablecoins as “a form of crypto-asset that aim to maintain a stable value relative to a specified unit of account or store of value,”[17] such as dollars or gold. A stablecoin has some or all of the characteristics of ‘money’, being a unit of account, a means of payment, and potentially as a store of value.[18]

Functionally, stablecoins therefore act as a bridge between a volatile Store (eg. Crypto) and a stable Medium (eg. USD). Tony Richards (Head of Payments Policy at the Reserve Bank of Australia), in a recent address,[19] identified three main functions for stablecoins, as:

- Trading Pairs: Stablecoins are used to bridge between Fiat currency and Cryptocurrency as a Medium for payment or settlement for transactions involving cryptocurrencies or tokenised assets. Stablecoins are also used as a Store of value for those wishing to transfer their assets from cryptocurrencies to fiat currency without leaving the blockchain ecosystem (eg. USD Tether $USDT).

- Institutional and reserve banking: large investment banks are proposing treasury and cross-border payments collateralised by assets, such as deposits at private or central banks.[20]

- A retail currency (referred to as a Global Stablecoin): a stablecoin aimed at retail use – for households or merchants using the stablecoin in everyday transfers and payments (eg. Facebook’s Diem, the coin formerly known as Libra). [21]

Structurally, three general approaches to stablecoin collateralisation (with the first two being subsets of asset-backed stablecoins) exist:

- Fiat-collateralised stablecoins

These asset-backed stablecoins maintain a stable value by reference to real or financial assets. These are typically fully collateralised and often centrally governed. Typically, the type of asset-backed stablecoins is:

- Fiat: Coins like USD Coin or Binance USD are typically backed by $1 of funds secured in a trust account in a third-party licensed financial institution. Ideally, the accounts are regularly audited to ensure stablecoins match collateralised funds. In some cases, the stablecoin is backed by a basket of currencies rather than a single currency (as Facebook’s Libra initially proposed)

- Asset-collateralised stablecoins

These asset-backed stablecoins maintain a stable value by reference to a single asset or basket of assets, typically commodities or crypto assets. They are typically backed by:

- Commodities: Coins like Paxos Gold and DigiX fall in this category. Each stablecoin is backed by 1 troy ounce of fine gold against either allocated gold (serialised and held in vaults) or unallocated gold (spot market with physical delivery) and is redeemable on demand. They are typically fully collateralised and governed by a centralised platform.

- Crypto Assets: Stablecoins such as MakerDAO’s DAI and Synthetix’s sUSD fall in this category and are over-collateralised and governed by decentralised protocols. For instance, in the case of DAI, each $1 of stablecoins is backed by $2 of ETH assets, allowing for liquidation in case of a sharp fall in ETH price.

- Algorithmic stablecoins

These tokens adjust supply – and in some cases, induce demand – deterministically (i.e. through a pre-determined algorithm).[22] Unlike the other stablecoins, algorithmic stablecoins are neither redeemable to, nor backed one-to-one by U.S. dollars. There are a number of general models of algorithmic stablecoins, offering either direct or indirect control over money supply, and the field is still developing. In direct price control models, price control is achieved by increasing or decreasing the supply of stablecoins in response to changes in demand, keeping the price of a stablecoin constant.[23] Methods of direct control include:

- Rebase model: the first iteration of algorithmic stablecoins (such as Ampleforth (AMPL), loosely based on Ametrano’s 2014 paper [24]) saw a rules-based, supply-elastic cryptocurrency that rebases according to demand. This means that the number of stablecoins in circulation in each user’s wallets is volatile while their total value is kept stable.

- Seigniorage Shares model: Similar to the rebase model but with a key distinction, instead of a rebasing currency, the system consists of two tokens, a supply-elastic stablecoin and Seigniorage Shares, which are tokens representing investment shares of the network. Seigniorage Shares holders are exposed to inflationary rewards when stablecoin demand is high and deflationary costs when stablecoin demand is low while the rest of the network experiences stability of both price and volume of stablecoin supply. (like Basis Cash, loosely based on Sam’s 2014 paper[25])

In contrast to the above, indirect price control deals with demand rather than supply. They do not directly expand and contract coin supply but offer the incentive framework for changing demand patterns. One such method is:

- Coupon model: When supply outstrips demand, devaluation is avoided by issuing bonds at a discount to face-value and utilising funds raised to buy on-market stablecoins, burning them (bringing them back to equilibrium its price to par value) when supply exceeds demand and redeeming them from bondholders by issuing new stablecoins when demand exceeds supply.

The regulatory approaches to stablecoins will differ for each stablecoin model structure described above, for every functional use and for every jurisdiction they are traded in.

US Regulatory Trends

The regulatory experience for stablecoins in the United States to date has been mixed:

- Tether, the largest stablecoin by market capitalisation, was recently fined US$41 million by the US Commodity Futures Trading Commission (CFTE) for misleading statements regarding its asset-backing having found that it had adequate cover for only 27.6% of the time sampled. Furthermore, Tether relied on unregulated third-party entities to provide custody, co-mingled its reserve, operational and customer funds; and held reserves in non-fiat financial products.[26]

- Paxos claims to take “a regulation-first approach to its products and service.”[27] Paxos launched the world’s first regulated stablecoin, the Pax Dollar (USDP) – redeemable and backed by USD in regulated and audited trust accounts, as well as Pax Gold (PAXG) – redeemable and backed by gold reserves held in secured vaults. Paxos operates under a trust regulated by the New York State Department of Financial Services.[28] TrueUSD (TUSD) have taken a similar approach to regulation.[29]

- Basis.io was the first centralised solution seeking to develop an algorithmic stablecoin with bond and share tokens alongside a stablecoin. After receiving advice that the bond and share tokens associated with their platform would be characterised as securities (even though the stablecoin itself was not), Basis decided it could not carry out the project and refunded investors the $133 million in funding it had raised.[30] The project has since been revived in decentralised form in Basis Cash, an unregulated non-custodial Decentralised-Finance (DeFi) platform.[31]

Recent US Developments suggest a tightening of regulation around stablecoins is likely in the near term. The recent report by President’s Working Group on Financial Markets (PWG) highlighted the risks of payment stablecoins and critical of gaps in its regulation.[32] The report recommended that Congress enact legislation, or in its absence, FSOC act without congressional approval, to designate some stablecoin activities as systemically important payment, clearing, and settlement activities which guard against stablecoin runs (the ‘bank run’ equivalent if confidence in stablecoin is low), monopolistic power, payment system risk and general risk-management standards.[33] FSOC in its annual reports, echoed the concerns about the risks posed by stablecoins as a means of payment creating a range of prudential concerns, and highlighting the need to manage risks relating to illicit financing, national security, cybersecurity, privacy and international monetary and payment systems integrity.[34]

The following is a summary of regulatory issues, categorised by functions and activities affecting stablecoins as identified by the Financial Stability Board:

| Functions | Activities |

|---|---|

| Governance of the arrangement |

|

| Issuance, redemption and stabilisation of value of coins |

|

| Transfer of coins |

|

| Interaction with users |

|

Adapted from the Financial Stability Board’s report[35]

Australian Market and Regulatory Trends

In Australia, both the use of stablecoins as a payment method and the supply Australian dollar-linked stablecoins has been very limited. Dark et al argue that the reason for low demand to date has been the fact that the alternative is a reliable, low-inflation store of value (the Australia Dollar) and an efficient payments network.[36] As such, no compelling proposition for widespread use of stablecoins exists in Australia.[37] Until recently, a few attempts have been tried without great success. The AUDRamp (AUDR) was the first Australian project to do so in 2018. It obtained approval as a managed investment scheme but does not appear to have ever reached active trading. TrueAUD (TAUD) was launched by TrustToken (the issuers of TrueUSD) in 2019,[38] but appears to not have significant trading volume or the liquidity required to stabilise its price at $1. Terra AU (AUT) is a new stablecoin built on the Terra ecosystem.

Promisingly for the market was the recent announcement by ANZ Bank of the launch of A$DC, a Fiat stablecoin pegged to the Australian dollar. The A$DC is backed $1 for $1 in a client trust account held at an ADI. This is the first Australian stablecoin backed by an authorised deposit-taking institution. ANZ is reported to be working with regulators, including APRA and AUSTRAC. [39]

In light of this milestone development coupled with the explosive growth in stablecoins over the past year, further regulatory clarity around stablecoins is warranted.

In June 2021, the Council of Financial Regulators (comprising of ASIC, APRA, RBA and Treasury) was forming a working group with other government agencies (including ACC, AUSTRAC, and the ATO) to study the effects of stablecoins on the Australian economy.[40] The report has yet to be released.

Reserve Bank officials, like their US counterparts, have been calling for greater regulation of stablecoins. Tony Richards (Head of Payments Policy at the RBA) recently suggested that “given the possibility that there could be a potential significant role for stablecoins in the settlement of transactions in tokenised assets, or that large retail-focused stablecoins could emerge, it is important that a suitable regulatory framework is developed”.[41]

Regulatory Considerations

In Australia, the key question in regulating stablecoins is whether a stablecoin is considered a financial product for the purposes of the Corporations Act 2001 (Cth) (‘Corporations Act’). If a stablecoin is a security, managed investment scheme or derivative or if it meets the general definition of a of a financial product (being a facility for making a financial risk, managing a financial risk or making a noncash payment), it will likely be considered a financial product and regulated under Chapter 7 of the Corporations Act. Restrictions will apply to those who can provide advice, trade, provide intermediary services, or operate a market in relation to such stablecoins.

Each stablecoin will differ in legal classification depending on the following:

- Structural characteristics: collateralised (1:1, under or over-collateralised); algorithmic

- Functional characteristics: Trading Pairs; Institutional and reserve banking; global stablecoin (retail)

- Asset backing: Fiat; Commodity; Real Estate; Crypto; or Nothing

The following questions may be used to analyse whether a stablecoin will amount to a financial product or not. As each stablecoin will differ in structure, function and asset-backing, it may be worthwhile reserve banking; a retail/global stablecoin.

- Is the stablecoin a facility for making a financial investment under s 763B (making a financial investment) or a Managed Investment Scheme under s 764A?

- 1.1. Does the fact the primary objective of the stablecoin is stability mean its purpose is not to “generate a financial return or other benefit” for the purposes of s 763B (making a financial investment) or “to produce financial benefits” [42] for the purposes of ss764A, 9 (Managed investment Scheme)?

- 1.2. In an algorithmic model, are the incentives offered a “financial return” under s 763B or “financial benefit” under s 9 (Managed investment Scheme)? If so, does the contributor have “day-to-day control” for the purposes of the act?[43]

- 1.3. Is there a pooling of contributions or a common enterprise for the purpose of s 9 (Managed Investment Scheme)?

- Is the stablecoin a security or debenture under s 764A?

- 2.1. What legal and equitable rights are attached to an asset-backed token?

- 2.2. Do bonds in the Coupon model amount to debentures?

- 2.3. Do Seigniorage Shares amount to securities?

- Is the stablecoin a derivative under s 761D?

- 3.1. Does the stablecoin platform offer an arrangement for future consideration (beyond 1 day)?

- 3.2. Is that consideration is determined in reference to the value of something else?

- Is the stablecoin a facility for managing financial risk under s 763C?

- 4.1. Is a stablecoin used to limit the financial consequences of price fluctuations, or rather,

- 4.2. Is the use of the stablecoin a way to managing the financial risk itself rather than mitigating its consequences?

- Is the stablecoin a facility for making a non-cash payment under s 763D?

(For this purpose, a functional analysis of how the stablecoin is utilised for payments is more appropriate than a structural analysis of the assets that back it.) [44]

-

- 5.1. Would a Global Stablecoin used for retail currency (as proposed by Facebook’s Diem) meet the definition of making a payment otherwise than through the physical delivery of cash?

- 5.2. Would a stablecoin used merely for trading pairs or for institutional and reserve banking meet the definition?

- Is it specifically included under s 764A?

- Is it specifically excluded under s 765A?

- Is the financial product aspect an incidental facility of a non-financial product purpose under s 763E?

- If the stablecoin is determined to be a security, derivative or interest in a managed investment scheme, can the issuer be said to be providing a Clearing and Settlement facility (CS facility) under s 768A(1)?

Conclusion

Stablecoins now represent 10% of the crypto market and are growing fast. With time, as web 3.0 adoption grows and smart contracts become ubiquitous in managing our financial life, demand for stablecoins will increase beyond the crypto world. [45] We are likely still at early phases of stablecoin market adoption.

Policy makers will need to balance between the competing needs of consumer protection (such as ensuring collateralised stablecoins are adequately backed) and the need to allow for innovation in this field to emerge. Reserve Bank governor Philip Lowe recently said, referring to privately-backed stablecoins:

If this is how the system develops, it will be important that these tokens are backed by high-quality assets and that they meet high standards for safety and security. One reason I say this is that a lesson from history is that privately issued and backed money all too often ends in financial instability and losses for consumers. This is one reason why national currencies are today ultimately backed by the state. So if privately issued stablecoins are ultimately the way things head, it will be crucial that they meet very high standards. And if there were to be multiple stablecoins, there would be advantages in them being interoperable. [46]

While stories like Tether misrepresenting their asset-backing give cause for concern for regulators, there is a risk that over-regulation may backfire and cause the stablecoin ecosystem to move to DeFi. This was the story of Basis, a project that having failed in the regulated environment (Basis.io) was reborn as a DeFi project (Basis.Cash) with the tagline: ‘Basis.io without Regulatory Risk’.[47] Overzealous regulation of stablecoins will lead projects down this path.

What may very well emerge is a two-tiered system: On one side, regulated fiat-collateralised, asset-backed stablecoins which apply client money rules, have third party trust custody, and are regularly audited (and AFS licenced if required) for institutional and mainstream retail investors. On the other hand, crypto investors will likely prefer an unregulated DeFi stablecoin, either asset-backed (overcollateralized crypto assets) or algorithmic (uncollateralised) with the user controlling their assets (on a noncustodial wallet) and monetary supply is governed deterministically.[48]

Whichever way regulation ultimately falls, we must heed the warning of John Maynard Keynes: “There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. ”[49] Whether the debauched currency is the stablecoin or the fiat that backs it remains to be seen.

Note: This article was originally published by the Author in the Law Society of WA’s latest Brief journal featuring Future Proof: Emerging Tech and Lawyers as: Eli Bernstein, ‘The Rise and Rise of Stablecoins’ (2022), 49(2), Brief (Law Society of WA), 22

Queries

For more information, please contact the author or any member of our Fintech, Privacy and Emerging Technologies team.

Disclaimer

This information and the contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders, and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.

__________

[1] Katherine Greifeld, ‘Stablecoins Soar in Value as Everything Else in Crypto Shrinks’, Bloomberg (Article, 24 February 2022) <https://www.bloomberg.com/news/articles/2022-02-24/stablecoins-soar-in-value-as-everything-else-in-crypto-shrinks>.

[2] James Eyers, ‘ANZ the first bank to mint an Australian dollar stablecoin, the A$DC’ Australian Financial Review (24 March 2022) <https://www.afr.com/companies/financial-services/anz-the-first-bank-to-mint-an-australian-dollar-stablecoin-the-a-dc-20220323-p5a743>.

[3] FSOC Annual Report, p124

[4] ‘Stablecoins by Market Capitalization’, CoinGecko (Web Page, 27 March 2022) <https://www.coingecko.com/en/categories/stablecoins>.

[5] William S Jevons, Money and the Mechanism of Exchange (1875), D. Appleton, London.

[6] A 1919 couplet based on Jevons, above n 4

[7] N. Gregory Mankiw, Macroeconomics (Harvard University, Worth Publishers, 9th ed, 2016) 82.

[8] Ibid 84.

[9] An ounce of gold worth $38 in 1971 is worth over $1900 as of today.

[10] Gold and property can therefore be said to be better Stores of value than Fiat Currency, as they are restrained by physical scarcity while Fiat is not. On the other hand, fiat currency is more transferable than gold or property, and acts as a better Medium of exchange and as a common Measure (especially in the case of the USD while it holds the status of a global reserve currency).

[11] Benn Steil and Manuel Hinds, Money, Markets, and Sovereignty (Yale University Press, 2009).

[12] In a clue to their motivation, Nakomoto embedded within the first block the following message and proof of date: ‘The Times 03/Jan/2009 Chancellor on brink of second bailout for banks’.

[13] Cameron Dark, David Emery, June Ma and Clare Noone ’Cryptocurrency: Ten Years On’, Reserve Bank of Australia (Bulletin, 20 June 2019) < https://www.rba.gov.au/publications/bulletin/2019/jun/cryptocurrency-ten-years-on.html >.

[14] Frederick A Hayek, Denationalization of Money: The Argument Refined, An Analysis of the Theory and Practice of Concurrent Currencies (1990, Third edition), Institute of Economic Affairs Online at <fee.org/resources/denationalization-of-money/>, accessed 20 March 2022.

[15] ‘10 Years After Laszlo Hanyecz Bought Pizza With 10K Bitcoin, He Has No Regrets’, CoinDesk (Web Page, 22 May 2020) <https://www.coindesk.com/markets/2020/05/22/10-years-after-laszlo-hanyecz-bought-pizza-with-10k-bitcoin-he-has-no-regrets/>, , accessed 27 March 2022.

[16] G7 Working Group on Stablecoins, Investigating the impact of global stablecoins (Report, October 2019) ii.

[17] ASIC, Submission 61, Senate Select Committee on Australia as a Technology and Financial Centre (June 2021) 6.

[18] Dark et al, above n 13.

[19] Tony Richards, ‘The Future of Payments: Cryptocurrencies, Stablecoins or Central Bank Digital Currencies’, Address to the Australian Corporate Treasury Association, Reserve Bank of Australia (18 November 2021) <https://www.rba.gov.au/speeches/2021/pdf/sp-so-2021-11-18.pdf> , accessed 20 March 2022.

[20] Related but distinguished from central Bank Digital Currency (CBDC): government-backed stablecoins such as the Chinese Digital Yuan, which the Australia and the US are both investigating its use case.

[21] Ibid.

[22] Benjamin Simon, ’Stability, Elasticity, and Reflexivity: A Deep Dive into Algorithmic Stablecoins‘ Mechanism Capital (Wep page, 21 December 2020) <https://www.mechanism.capital/algorithmic-stablecoins/>.

[23] Ibid.

[24] Ferdinando M. Ametrano, Hayek Money: The Cryptocurrency Price Stability Solution (April 2014; Revised: August 2016). Available at SSRN: https://ssrn.com/abstract=2425270 or http://dx.doi.org/10.2139/ssrn.2425270, , accessed on 20 March 2022.

[25] R. M. Sams, A Note on Cryptocurrency Stabilisation: Seigniorage Shares (October 2014, Revised: April 2015)

Available at https://github.com/rmsams/stablecoins/blob/master/paper.pdf, accessed on 20 March 2022.

[26] CFTC Press Release 8450-21, 15 October 2021 <https://www.cftc.gov/PressRoom/PressReleases/8450-21>, accessed 27 March 2022

[27] Paxos, www.paxos.com, , accessed 27 March 2022

[28] Ibid

[29] Dark et al, above n 13

[30] Basis <www.basis.io>, , accessed 27 March 2022

[31] Basis Cash <www.basis.cash>, , accessed 27 March 2022

[32] Issued on November 1 2021 along with the Office of the Comptroller of the Currency (OCC) and Federal Deposit Insurance Corporation (FDIC).

[33] ‘Report on Stablecoins,’ President’s Working Group on Financial Markets (PWG), the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) (November 2021) <https://home.treasury.gov/system/files/136/StableCoinReport_Nov1_508.pdf >

[34] 2021 Annual Report, Financial Stability Oversight Council, US Department of Treasury (17 December 2021) <https://home.treasury.gov/system/files/261/FSOC2021AnnualReport.pdf>.

[35] From Table 1: Functions and activities in a stablecoin arrangement in ‘Addressing the regulatory, supervisory and oversight challenges raised by “global stablecoin” arrangements,’ Financial Stability Board, p10 (14 April 2020).

[36] Dark et al, above n 13.

[37] Ibid, 210.

[38] Ibid.

[39] James Eyers, ‘ANZ the first bank to mint an Australian dollar stablecoin, the A$DC’ Australian Financial Review (Article, 24 March 2022) <https://www.afr.com/companies/financial-services/anz-the-first-bank-to-mint-an-australian-dollar-stablecoin-the-a-dc-20220323-p5a743>.

[40] ASIC, Above n 16

[41] Tony Richards, above n 15

[42] As defined in s9

[43] The answer may vary depending on the level of decentralisation and user control. A centralised infrastructure (CeFi) holding custody of the stablecoin offers far less “day-to-day control” than a decentralised platform (DeFi) running on pre-set rules where the user controls their stablecoins on a noncustodial wallet.

[44] That said, a structural analysis would nevertheless be beneficial to determine whether the stablecoin is comparable to elements specifically included as making a non-cash payment (such as traveller’s cheques, stored value cards or electronic cash) or those specifically excluded (such as a means of guarantee given by a financial institution).

[45] For example, an insurance smart contract could offer a refund if a flight is delayed (using flight departure data source as an oracle). To do so, it would require to lock digital currency in a smart contract to be released to the insured upon the insurable event occurring, resulting in fully automated claims process. Users are likely to prefer an AUD-pegged policy than one that pays out in Ethereum.

[46] Philip Lowe, ‘Payments: The Future?’ Reserve Bank of Australia (Address to the Australian Payments Network Summit 2021, 9 December 2021) <https://www.rba.gov.au/speeches/2021/sp-gov-2021-12-09.html>.

[47] Basis Cash, above n 31

[48] As advocated by Henry C Simon, “Rules versus Authorities in Monetary Policy,” Journal of Political Economy 44 (1936) 1-30 and agreed to by Frederick A Hayek in “The Monetary Framework,” The Constitution of Liberty, University of Chicago Press, 1960.

[49] John Maynard Keynes, The Economic Consequences of the Peace (Harcourt, Brace and Howe, 1920).