Commencement of a new regime: The Corporate Collective Investment Vehicle (CCIV)

Introduction

An entirely new type of collective investment vehicle is about to become available in Australia. The idea for a broader range of collective investment vehicles that provide flow-through taxation was first raised in a report by the Australian Financial Centre Forum back in 2009. After more than a decade of debate and legislative and regulatory preparations, the new vehicle is ready for operation.

Following several rounds of draft legislation and public consultation, the Corporate Collective Investment Vehicle Framework and Other Measures Bill 2021 (Bill) received royal assent on 22 February 2022, with a commencement date of 1 July 2022 for the new Chapter 8B of the Corporations Act 2001 (Cth) (Corporations Act). In addition, ASIC has issued draft guidance and ASX has released proposed amendments to the ASX Listing Rules to facilitate listing of CCIV sub-funds.

What is a CCIV?

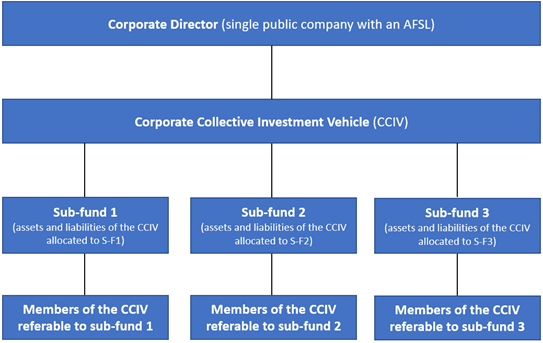

A CCIV is a company limited by shares, with a single corporate director, that must be a public company (holding a new form of CCIV-specific AFSL); and its assets and liabilities are segregated into sub-funds. A CCIV must have a constitution that meets prescribed content rules.

The Bill amends the Corporations Act to establish a CCIV as a new type of company. Like the existing Managed Investment Scheme (MIS) regime there are two types of CCIVs: wholesale and retail. Both types must be registered with ASIC, with retail CCIVs subject to a stricter regulatory framework, including the requirement for the corporate director to have a retail AFSL. Unlike an MIS, there is no separate responsible entity, and the CCIV legislation does not require there to be a separate custodian or depositary, though the CCIV may choose to appoint a custodian to align with current Australian practices or to meet other regulatory requirements.

The structure of an example CCIV

The corporate director:

- is taken to have provided any financial services performed by the CCIV – with the exception of issuing securities in the CCIV, which is undertaken by the CCIV itself;

- is required to obtain a newly introduced AFSL authorisation to ‘operate the business and conduct the affairs of the CCIV’;

- must have at least 50% of its directors as external directors (for retail CCIVs), to ensure a degree of detached supervision; and

- owes the same duties and obligations as the responsible entity or corporate trustee of a MIS.

The CCIV:

- has no employees or officers;

- may appoint a custodian; and

- must have at least one sub-fund, and each sub-fund at least one member.

Sub-funds

While a sub-fund is not a separate legal entity, the business of the CCIV is run through its sub-funds. This means that while the CCIV holds assets, incurs liabilities and enters into contracts, each of these actions must be allocated to one of its individual sub-funds.

Each sub-fund must be registered individually and given its own Australian registered fund number (ARFN) and name, allowing third parties to be aware of which sub-fund they are contracting with. The segregation of each sub-fund helps protect investors by quarantining the business of each, meaning one sub-fund can be wound up without affecting another.

Meetings, shares and the company constitution

Members of a sub-fund are also members of the CCIV, and there are no members of the CCIV that are not members of a sub-fund. A meeting of the members of the whole CCIV (or a sub-fund of the CCIV) may be called by the corporate director or by a member. The members of the CCIV may vote to remove the corporate director. Members hold shares in the CCIV itself referable to a specific sub-fund, receiving returns and voting power proportionate to the value of their shares in that sub-fund.

Many of the rules that apply to issuing or reducing share capital in an ordinary company do not apply to a CCIV, given its variable capital nature. There is also the option of adopting a closed-ended structure, where the share capital is fixed or limited.

Both wholesale and retail CCIVs must have a constitution, as the replaceable rules contained in the Corporations Act are not applicable. There is no template constitution, though retail CCIVs must make provision for certain prescribed matters (largely based on the requirements for constitutions of registered schemes).

Benefits of a CCIV

Global familiarity

The key driver behind introducing the CCIV is to stimulate foreign investment in the Australian funds management industry, by using a corporate structure that is more familiar to overseas investors. Consistent with investing in other jurisdictions, investors will purchase a share in a corporate entity and receive a return on their investment, which receives flow-through taxation treatment.

Regulatory alignment

Before the CCIV, foreign fund managers were generally required to adopt the MIS trust structure and AMIT attribution to provide a tax-effective product to investors, which may not be compatible with the structures required in their home jurisdiction. The cost of running two structures can impede the ability of these funds to offer their products in Australia. The CCIV creates a global regulatory alignment that aims to lower these barriers to entry for new fund managers seeking to operate in Australia.

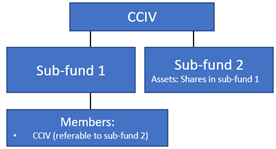

Consolidation and cross-investment

The umbrella structure means that each sub-fund may offer investors a different investment strategy. Being able to group these different funds together under one vehicle is intended to support fund managers to build capacity and economies of scale.

Following on from this, the CCIV is also able to cross-invest between sub-funds. This means a CCIV can acquire, in respect of one sub-fund, shares that are referable to another sub-fund of the same CCIV. The acquired shares are held as an asset for the acquiring sub-fund, with the CCIV itself acquiring rights as a member of the other sub-fund.

Cross-investment example

This cross-investment allows fund managers to pool assets in one sub-fund and offer investment opportunities in these pooled assets through the other sub-funds with varying levels of exposure or different currencies, under the same CCIV.

Listing

The following may be listed on a prescribed financial market operated in Australia:

- a retail CCIV with only a single sub-fund; or

- the sole sub-fund of a retail CCIV.

Therefore, any other type of CCIV or sub-fund cannot be listed, including wholesale CCIVs, retail CCIVs with multiple sub-funds, and the sub-funds of these structures. However, the Federal Government has flagged that the listing of a retail CCIV with multiple sub-funds will be considered once the regime is in operation.

Tax

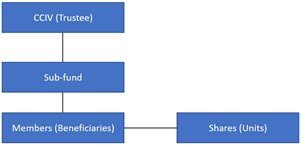

To allow flow-through tax treatment, a CCIV is taxed as a trust rather than as a company, despite its legal form. The CCIV regime leverages the existing attribution managed investment trust tax framework (AMIT) introduced in 2016, by deeming each sub-fund to be a unit trust under which:

- the CCIV is a trustee;

- the members of the sub-fund are beneficiaries; and

- shares of the sub-fund are taken to be units in the trust.

Deemed unit trust structure

A beneficiary of the CCIV sub-fund trust is taken to:

- have a fixed entitlement to a share of the income and the capital of the trust; and

- be presently entitled to a share of the income of the trust estate, so that in most cases the CCIV itself is not subject to tax.

However, if the CCIV does not qualify as an AMIT, it will be taxed under the general trust provisions (or those of a public trading trust if the sub-fund carries on or controls a trading business). Under the general trust provisions, the beneficiaries of the CCIV sub-fund trust are taxed on their share of the net income of the trust, and the trustee is taxed on any of the remaining net income not attributed to a beneficiary.

This deemed trust regime is much more favourable than the alternative of being taxed as a company, which would have left the CCIV to be taxed at the top corporate tax rate and unable to frank distributions to members. A CCIV that is taxed as a public trading trust is not prohibited from making frank distributions.

Implementation and outlook

The similarities between the CCIV regulatory regime and that of the existing MIS are aimed to encourage ease of adoption for fund managers and assist the transition of MIS members into a CCIV. However, as existing MIS investors are already familiar with trust structured investments, they may be hesitant to switch to a CCIV. This hesitancy may be furthered by a new tax interpretation that is unfamiliar and untested, and concerns regarding the duty and land tax implications of restructuring MIS property funds into a CCIV.

While overseas investors and fund managers will surely welcome the new vehicle, how willing stakeholders in Australia are to adopt the CCIV structure will be a great source of interest come 1 July 2022.

Queries

For further information please contact an author, or any member of our Corporate & Commercial team.

Disclaimer

This information and the contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders, and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.