Gateways and Risk Assessments: The ATO’s compliance approach to the allocation of professional firm profits

Overview

There has been an accelerated shift towards professional services firms (comprising engineers, accountants, pharmacists, architects, and medical and allied health professions etc) adopting a corporate or hybrid structure (Alternative Structure) in place of the more traditional partnership of natural persons. This shift has created an area of compliance focus for the ATO and a need for taxpayers to have a clear understanding of what constitutes legitimate profit allocation within an Alternative Structure, as distinct from practices that may be inappropriately tax-driven.

Context

Professionals who have an ownership interest in an Alternative Structure commonly become entitled to two types of income distributions in respect of a relevant period:

- an amount representing the value of personal services provided to the firm’s clients (Remuneration); and

- a distribution representing a portion of the value generated by the firm’s business structure, proportionate to their equity interest in the Alternative Structure (Profit Distribution).

The ATO intends to target arrangements that may alter a professional’s tax liability by redirecting income to an associated entity in circumstances where that income may, thematically, be more appropriately attributable to personal services (however, as a technical matter, partnership income does not necessarily comprise a portion of personal services income) – that is, inflating Profit Distribution and understating Remuneration.

Compliance approach

While the ATO retains all its compliance powers in respect of this issue (including Part IVA of the Income Tax Assessment Act 1936 (Cth) (ITAA 1936)), it seems clear that requiring professionals to self-assess is a substantial part of its overall strategy to achieve widespread compliance.

The ATO has released Draft Practical Compliance Guideline PCG 2021/D2 (Draft Guideline) to facilitate self-assessment. The Draft Guideline sets out the details of the regime, which involves two ‘gateway’ tests that must be passed in order for the taxpayer to proceed to the next step, which is self-assessment against a more detailed risk assessment matrix (if the gateway tests are not passed, the taxpayer must engage with the ATO). The aggregated result of the self-assessment then attracts a low, moderate or high risk level. Low risk levels will attract standard ATO compliance treatment. Moderate and high risk arrangements require active engagement with the ATO.

Salaried partners whose remuneration historically comprised, in part, a distribution to an associated entity, fall outside the Draft Guideline and will also no longer be able to take advantage of the safe harbours set out in the 2015 version of the guidelines (which have been superseded by the Draft Guideline). Any person or business involved in such an arrangement will now need to assess their circumstances against the case law arising from Part IVA of the ITAA 1936.

Gateway tests

The gateway tests are designed to capture high risk arrangements and prevent them from proceeding any further in the self-assessment process.

Gateway 1: The arrangement must be commercially driven

There must be a commercial rationale for the arrangement that is documented, assessable and consistent with the economic and structural realities of how the firm operates in practice. For example, a commercial rationale of ‘asset protection’ must deliver a substantive improvement to that variable. Further factors to be considered are as follows:

- the arrangement is not more complex than it needs to be;

- improved tax outcome is not the only benefit of the arrangement; and

- the arrangement is permitted and within the scope of the relevant constituent documents (eg constitution, partnership agreement, internal policies etc).

Gateway 2: Absence of high-risk features

The following arrangements are considered to have high-risk features:

- financing arrangements relating to non-arm’s length transactions;

- exploitation of the difference between accounting standards and tax law;

- arrangements where a partner assigns a portion of a partnership interest in a way that is materially different to the High Court decision in Federal Commissioner of Taxation v Everett [1980] HCA 6 (which involved the permitted assignment of a partnership interest to a related party where the income was deemed to be flowing from the business structure and not from personal services); and

- multiple classes of shares and units held by non-equity holders.

The taxpayer must also have regard to any Taxpayer Alerts released which identify additional arrangements considered to have high-risk features.

Risk assessment

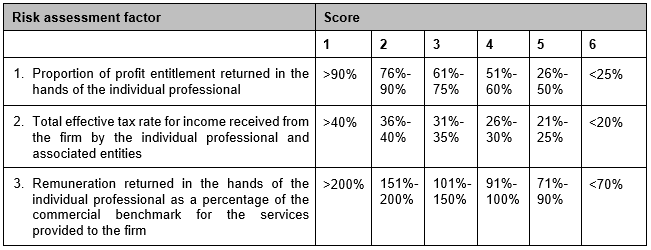

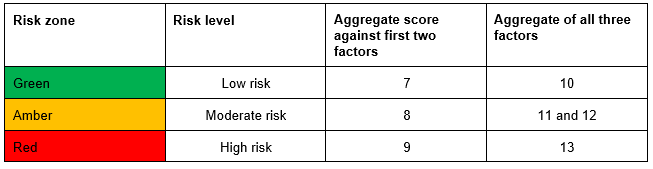

The risk assessment matrix and method of allocating risk level (as set out in the Draft Guideline) are reproduced below. In essence, the more profit that is allocated to the individual professional and the higher the collective effective tax rate of the individual professional and their associated entities, the lower the risk level. However, the 50% Remuneration allocation and 30% effective tax rate ‘safe harbours’ that existed under prior guidelines would generate a risk score of 9, resulting in at least a moderate risk level (although 51% Remuneration allocation and 31% effective tax rate may result in a low risk level).

Matrix

Risk level

Next steps

- The Draft Guideline is not yet in final form (comments close on 26 March 2021) but will most likely be adopted with minimal substantive amendments.

- Firms will typically need to distribute profits in a way that results in at least 51% being received by the individual professional in Remuneration, meaning a 31% or more effective tax rate for the professional and their associated entities.

- It is essential for adequate compliance that all professional services firms take steps to:

- apply a tax planning lens to any profit allocation made in respect of the current financial year;

- from 1 July 2021 (or 1 July 2023 if qualifying for the transitional provisions; ie, commercially driven arrangements without high-risk features entered into prior to 14 December 2017):

- undertake a profit allocation risk assessment as set out in the final version of the Draft Guideline;

- document – and compile supporting material to evidence the conclusions of – the risk assessment; and

- implement an annual risk assessment review process.

- Firms should consider whether a broader review of tax compliance in respect of profit allocation practices is required (eg non-recognition of capital gains, avoidance of Division 7A of Part III of the ITAA 1936, income injection to entities with excess losses etc), particularly if there is an intention to engage with the ATO directly in respect of a moderate or high risk arrangement.

Further information

ATO Draft Practical Compliance Guideline PCG 2021/D2 (see: PCG 2021/D2 | Legal database (ato.gov.au))

Questions

For further information regarding the above, please contact the author or any member of our Tax team.

Disclaimer

This information and contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.