2021/2022 Victorian State Government Budget Update: Relief for developers, concessions to move excess housing stock, cash grab on windfalls

Introduction

The 2021/22 Victorian State Government Budget delivered on a revenue raising objective by implementing frank rate increases to both recurrent and transactional stalwart taxes and duties (eg land tax, transfer (stamp) duty), as well as introducing a new ‘health and wellbeing’ payroll tax surcharge and a tax on ‘windfall’ increases in land value arising from rezoning decisions – all to tackle the $17.4 billion ‘monster deficit’.

The Government also implemented targeted concessions (including a generous transfer duty exemption to move new stagnant housing stock in Melbourne CBD and surrounding suburbs), to support property developers and the construction industry.

There was plenty of tweaking to various thresholds, which may create the impression of a net concessional approach. However, in many cases, the real terms tax relief will be nominal.

Key measures include:

- 1% increase to the transfer duty rate on ‘premium rate’ property transactions (ie those exceeding $2 million);

- land tax rate increases of between 0.25% and 0.30% for landholdings valued above $1.8 million;

- a new ‘windfall gains tax’ (maximum 50%) on land value uplifts of $100,000 or more;

- transfer duty concession and exemption for purchases of new residential property within the City of Melbourne Local Government Area;

- temporary increase to the ‘off-the-plan’ transfer duty concession threshold to $1 million;

- vacant residential land tax exemption for newly completed homes that remain vacant for up to two years following completion; and

- 0.5% to 1% ‘health and wellbeing levy’ on businesses with Australia-wide wages over $10 million and $100 million (respectively).

Set out below is a brief summary of the key measures announced in the Budget.

New transfer (stamp) duty rate for high value transactions

A new higher 6.5% duty rate (up from 5.5%) will apply on the dutiable value of property transactions exceeding $2 million, to raise the overall duty rate to $110,000 plus 6.5% on the amount exceeding $2 million.

The new ‘premium rate’ will apply to contracts executed on and after 1 July 2021.

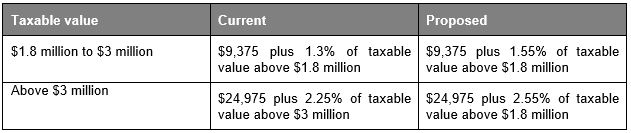

Land tax increase for land valued above $1.8 million

The land tax rates are set to increase (by between 0.25% and 0.30%) where the unimproved value (ie taxable value) of landholdings (ie aggregated by landholder) is above $1.8 million. The rate increases apply to an extraordinarily broad tax base; this is arguably the most significant revenue raising measure set out in the Budget.

The increases will apply from the 2022 land tax year onwards (based on land ownership details as at midnight on 31 December 2021).

Windfall gains tax

A new 50% ‘windfall gains tax’ will tax uplifts in value arising from the rezoning of land from 1 July 2022 onwards. The tax will have a phased introduction, with uplifts from $100,000 triggering the additional tax, up to a maximum rate of 50% for uplifts of $500,000 or more.

The Government has yet to announce full details of how the tax will be administered in practice, including in respect of whether the tax will be payable prior to profits being realised (or conversely, the circumstances in which tax deferral will be granted), and how the new tax will interact with the Federal Government’s capital gains tax regime to prevent double taxation.

Temporary transfer (stamp) duty concession for property within the city of Melbourne local government area (LGA)

The Government has introduced a new temporary transfer duty exemption (applying to 100% of the dutiable amount, excluding ‘foreign purchaser additional duty’ (if applicable)). The exemption applies to the transactions that have all the features set out below:

- purchases of new residential property valued up to $1 million;

- the property has remained unsold for at least 12 months after completion; and

- the property is within the City of Melbourne LGA (eg CBD, Southbank, Port Melbourne, Carlton, Parkville etc),(collectively, Exemption Criteria).

A temporary 50% transfer duty concession will apply where the transaction concerns property that does not meet the ‘unsold for at least 12 months’ criteria but otherwise satisfies the Exemption Criteria.

The 100% exemption will apply where the relevant contract is executed between 21 May 2021 and 30 June 2022. The 50% concession applies for contracts executed between 1 July 2021 and 30 June 2022.

Temporary widening of the off-the-plan duty concession

The Government has broadened the existing ‘off-the-plan’ transfer duty concession by raising the dutiable value threshold to $1 million (up from $750,000 for first home buyers or $550,000 for other home buyers).

‘Dutiable value’ in this context refers to, in broad terms, the amount calculated by subtracting construction costs incurred after the contract date from the contract price. Accordingly, it will most benefit those purchasers who execute contracts in the pre-construction or early-stage construction phase of a development project.

The higher threshold applies to contracts executed between 1 July 2021 and 30 June 2023.

Vacant residential land tax

Newly completed homes will be exempt from ‘vacant residential land tax’ for two years after completion in circumstances where the residence has not been used or occupied and has not changed ownership.

This exemption aims to give concessional treatment to property developers by reducing the recurring expenses associated with maintaining excess housing stock and will apply from the 2022 land tax year onwards.

Payroll tax

The tax-free threshold for payroll tax has been raised from $650,000 to $700,000, effective 1 July 2021. The planned decrease in the payroll tax rate for regional employers (from 2.02% to 1.2125%) has also been brought forward to 1 July 2021.

Businesses with an annual payroll tax liability of $100,000 or less (an increase to the prior annual liability threshold of $40,000) can elect to report and pay their payroll tax liability annually.

Health and wellbeing levy

The introduction of the ‘health and wellbeing levy’ is an interesting linkage of revenue-raising activity with a specific item of general expenditure (ie mental health programs and services). The 0.5% levy will be a payroll tax surcharge on businesses with annual Australia-wide wages totalling between $10 million and $100 million. The levy will increase to 1% in respect of wages above $100 million. The levy will take effect on 1 January 2022.

Payroll tax grouping and exemption categories (eg charities, hospitals, schools etc) are two issues that might benefit from additional consideration as a result of the introduction of this levy.

Additional resources

For further information, please see:

Victorian State Government Budget Papers: 2021-22 State Budget | Department of Treasury and Finance Victoria (dtf.vic.gov.au)

Victorian State Revenue Office: State Budget 2021-22 announcements | State Revenue Office (sro.vic.gov.au)

#payrolltax #landtax #transferdutyconcessions #healthandwellbeingsurchage

Queries

For further information regarding the above, please contact the author Lesley Naik, Senior Associate, at l.naik@cornwalls.com.au, or any member of our Tax team.

Disclaimer

This information and contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.